Tax Fraud Under Sales Tax Act 1990 Pakistan

Legal Reference : Section 2(37) - Sales Tax Act, 1990

What is Tax Fraud in Sales Tax Act, 1990 ?

Tax fraud under the Sales Tax Act, 1990 is not just a Clerical error – it’s a serious offense that includes acts like:

- Hiding true supplies

- Claiming fake input tax credits

- Issuing invoices without actual goods

- Not depositing collected tax within 3 months

- Using fake records or documents

- Dealing with confessable goods

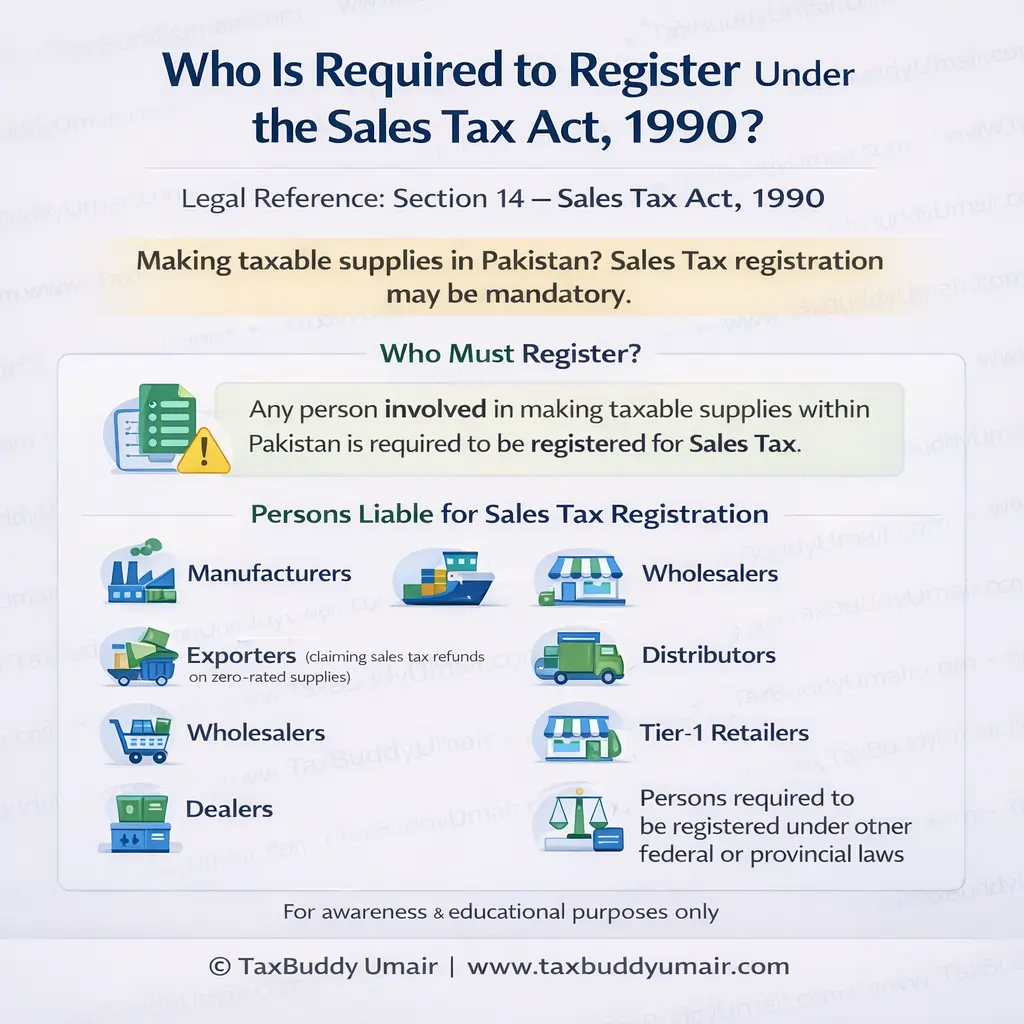

- making of taxable supplies without getting registration

- Any intentional act that causes loss of tax

- Issuing any invoices without supply of goods leading to inadmissible claim of input tax credit or refund

If a registered or unregistered persons is involved in any of the aforementioned tax frauds, they are committing tax fraud under Section 2(37) of the Sales Tax Act, 1990, and are liable to penalties in accordance with the law.